The drafting of an invoice requires particular attention to the obligatory details on an invoice, crucial elements in ensuring its legality and conformity. These details, essential for both supplier and customer, guarantee the transparency of commercial transactions.

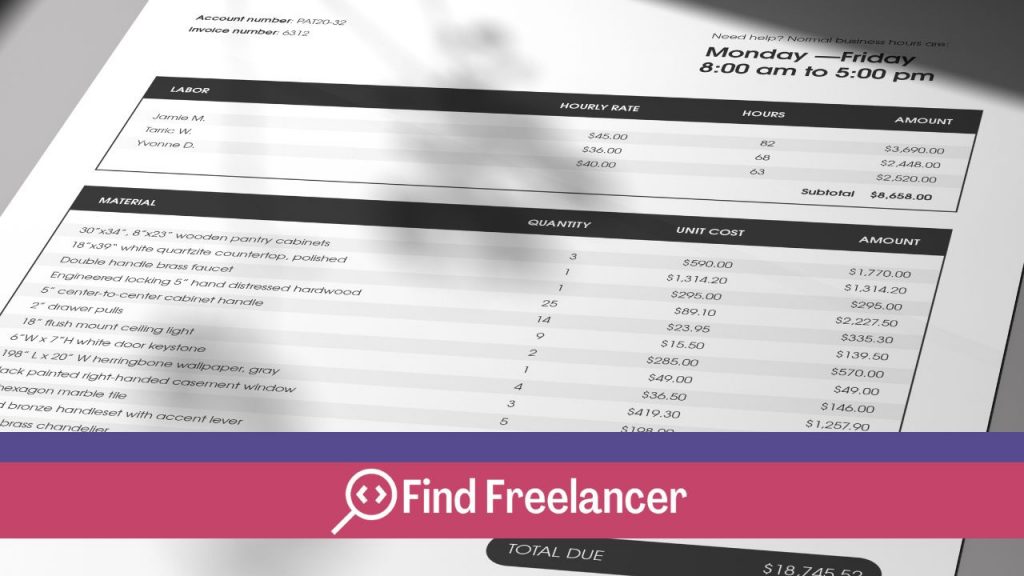

Mandatory information generally includes full contact details for the sender and recipient, the date of issue, a unique invoice number, a detailed description of the goods or services supplied, the amounts exclusive of tax and inclusive of all taxes, and the applicable VAT rate. This article explores in detail the importance of these mentions, offering a clear guide to issuing invoices in full compliance with current legislation.

What must be mentioned on an invoice in France?

In France, several items of information are mandatory on an invoice to guarantee its tax and legal validity. Here are the main statements to include:

Full contact details of the invoice issuer:

- Company name or trade name

- Physical address.

- Phone number.

- Email address.

.

Complete contact details of the invoice recipient:

- Name or company name of customer.

- Physical address.

Invoice details:

- Invoice issue date.

- Unique, chronological invoice number.

Detailed description of goods or services provided:

- Nature of goods or services.

- Quantity supplied.

- Total amount excluding taxes.

- Mention of the VAT rate applied to each good or service.

- Payment deadline.

- Conditions of payment.

Respecting these mandatory details is essential to avoid tax penalties and ensure correct accounting traceability. Companies must pay particular attention to these requirements when issuing their invoices. Compliance with mandatory information on an invoice is of crucial importance for a number of reasons, both from a legal and a practical point of view. Here are just a few reasons why it’s important to comply with the obligatory mentions on an invoice: Non-compliance with mandatory information can result in legal penalties. In France, for example, the tax authorities can impose fines for invoicing that doesn’t comply with established rules. Companies receiving invoices are entitled to deduct the VAT mentioned on them. However, the absence of compulsory information can lead to this right being called into question, with potentially significant financial consequences. Required information facilitates accounting traceability. They enable companies to properly document their transactions, which is essential for accurate accounting and the preparation of any audits. Clear, compliant invoices strengthen trust between business partners. They provide transparent information on transactions, helping to establish solid business relationships. Required information helps to organize and archive accounting documents efficiently. This simplifies administrative management and makes it easier to find information when you need it. In short, respecting the mandatory information on an invoice is essential to comply with regulations, avoid penalties, maintain healthy commercial relations, ensure accurate accounting and facilitate administrative management. It’s a fundamental aspect of good corporate governance. Non-compliance with mandatory information on an invoice can entail various risks and penalties, both legal and financial. Here are some of the risks incurred in the event of non-compliance: Tax authorities can impose fines for non-compliant invoicing. These fines vary according to the seriousness of the non-compliance, and can represent a percentage of the amounts involved. . In the absence of mandatory information, the right to deduct VAT may be called into question. Companies receiving non-compliant invoices risk losing the benefit of this deduction, thus incurring additional financial costs. The right to deduct VAT may be called into question. In the event of a tax audit, the absence of mandatory information can lead to complications. The tax authorities may request additional information, prolonging the duration and complexity of the audit. In addition to tax fines, administrative sanctions may be imposed, such as financial penalties or activity restrictions, in cases of repeated or serious non-compliance. Non-compliant invoicing can have repercussions on a company’s image. This can affect the confidence of business partners and damage the company’s reputation in the marketplace. It is therefore imperative for companies to ensure that they scrupulously respect the obligatory statements on their invoices in order to avoid these potential risks. Rigorous invoice management contributes to legal compliance, financial transparency and healthy business relationships. It’s important for companies to be scrupulous about the information required on their invoices in order to avoid these potential risks. Yes, the mandatory information on an invoice varies from country to country due to differences in tax and trade legislation. Each country establishes its own rules and requirements for invoicing to ensure the transparency of commercial transactions and facilitate tax collection. For example, in France, mandatory information includes the parties’ contact details, a description of the goods or services, the amounts before and after tax, and the applicable VAT rate. . Variations may concern invoice format, specific information required, or numbering rules. Some countries may require additional information, such as specific tax references. Companies operating internationally need to pay particular attention to these differences to avoid penalties, maintain legal compliance and facilitate cross-border trade. Understanding national specificities in invoicing contributes to the efficient and compliant management of business transactions on a global scale.Amounts exclusive of tax and inclusive of all taxes:

The applicable VAT rate:

Payment terms:

Why is it important to respect the obligatory mentions on an invoice?

Legal compliance

Right to VAT deduction

Accounting traceability

Business relations

Easier administrative management

What are the risks incurred in the event of non-compliance with compulsory information on an invoice?

Tax fines

Challenging the right to deduct VAT

Complications during a tax audit

Administrative penalties

Impacts on the company’s image

Does the mandatory information on an invoice vary from country to country?